Making sense of current market conditions

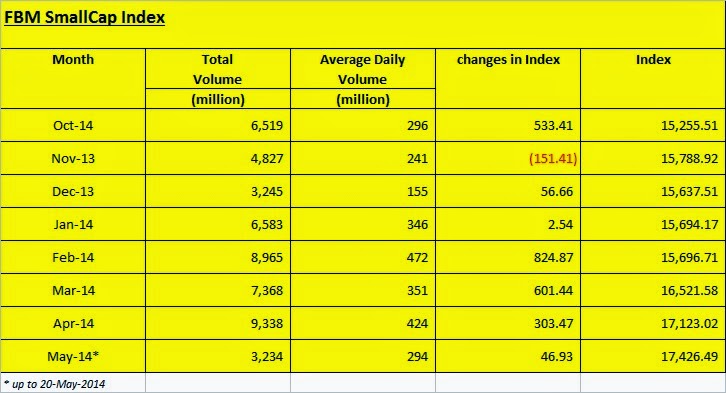

This month is relatively unexciting as compared to last month April.

The following was reported in the newspaper:-

"Investors in small-cap stocks have had a rough few weeks as the money flow shifted to bigger companies but analyst at RHB Research Institute are betting there are still plenty of good buys with strong growth potential in the market".

I cannot help but cringed after reading such news article. I could agreed to the last part of the statement where it mentioned there are still plenty of good buys in small cap companies (read here) but I disagreed that "investors in small-cap stocks have had a rough few week...". The choice of word "investor" is incorrect here. It should be retail players and not so much of investors. Investors do not look at few-weeks timeframe horizon. Retail players do. The tone of the whole news article is very much skewed toward retail play mentality.

If you have bought stocks late last year or early of this year and you have keep your investment intact until now, high chance is you are still making good paper gains. Thus, the past few weeks are not rough weeks to you. Your paper gains may have slide but still make good gains. But if you have bought stocks last month April, maybe and only maybe, you could be making paper loss or stagnant. No worry about that. I too had made my latest purchase on OCK at RM 1.42 last month. It has not give me good profit yet but certainly not paper loss or rough few-weeks. My point is, if you keep for longer timeframe, the so-called rough-few-weeks will be neutralised by better market mood in Q3 and Q4 of the year.

If you still have capital to invest, these 2 months will be opportunity to shop for good companies especially after the listed companies release their financial report. Not that good companies suddenly present itself out of the blue but the current market sentiment is a good time to pick reasonable priced stock without all the hypes as witnessed during exciting time. However, I think many have almost or fully invested their capital by now. If that is the case, you just have to ride through the current unexciting market sentiment.

good observation uncle!

ReplyDelete