Saturday 24 May 2014

Wednesday 21 May 2014

Making sense of current market conditions

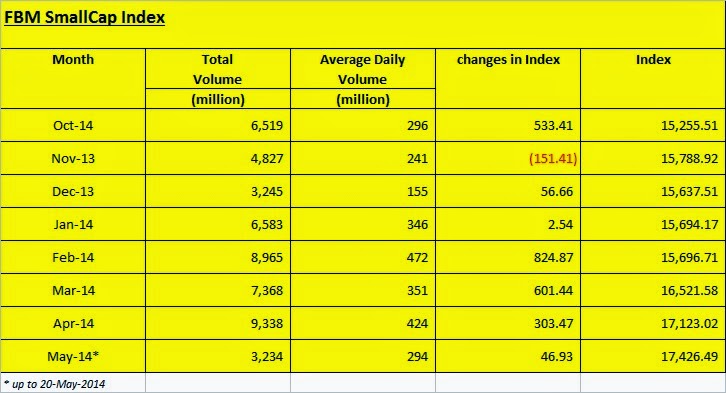

This month is relatively unexciting as compared to last month April.

The following was reported in the newspaper:-

"Investors in small-cap stocks have had a rough few weeks as the money flow shifted to bigger companies but analyst at RHB Research Institute are betting there are still plenty of good buys with strong growth potential in the market".

I cannot help but cringed after reading such news article. I could agreed to the last part of the statement where it mentioned there are still plenty of good buys in small cap companies (read here) but I disagreed that "investors in small-cap stocks have had a rough few week...". The choice of word "investor" is incorrect here. It should be retail players and not so much of investors. Investors do not look at few-weeks timeframe horizon. Retail players do. The tone of the whole news article is very much skewed toward retail play mentality.

If you have bought stocks late last year or early of this year and you have keep your investment intact until now, high chance is you are still making good paper gains. Thus, the past few weeks are not rough weeks to you. Your paper gains may have slide but still make good gains. But if you have bought stocks last month April, maybe and only maybe, you could be making paper loss or stagnant. No worry about that. I too had made my latest purchase on OCK at RM 1.42 last month. It has not give me good profit yet but certainly not paper loss or rough few-weeks. My point is, if you keep for longer timeframe, the so-called rough-few-weeks will be neutralised by better market mood in Q3 and Q4 of the year.

If you still have capital to invest, these 2 months will be opportunity to shop for good companies especially after the listed companies release their financial report. Not that good companies suddenly present itself out of the blue but the current market sentiment is a good time to pick reasonable priced stock without all the hypes as witnessed during exciting time. However, I think many have almost or fully invested their capital by now. If that is the case, you just have to ride through the current unexciting market sentiment.

Friday 16 May 2014

The story continues....

Looking back last year when I told my associates who has placed their trust in me, to be patient at times when the stock price fell below 0.80. I remember I made a pledge with them that if the price continue to fall and fall below 0.70, I will cover their losses. Here. Fast forward to today, most of them have make 100% paper gains with current price. Naturally, some had asked me would it be good time to sell now. This I can understand as it is very human nature to want to "feel" the profit on our hands rather than on paper. I told them if they wanted to use the money or put back into FD, then please do so. If, and a big if, to re-invest the money into another stock, then I suggested to them to stay put for the time being. As the saying goes, the devil you know is better than go for the angel you don't know.

OCK might have gave you the roller coaster ride but at the end, it did not failed to give good returns. I am very satisfy with the outcome and they are lucky enough to make 100% in a year. Well, in fact it is less than a year. I would not tell them to keep invested in this stock so that could make another 100%. That's not my way. I could only tell them this company has many more potentials to come. I have faith in OCK even at current price, just like I have faith when its price was mere 60 cents when many said my faith was very dull at that time. But now everyone is talking about this oldman stock.

Let me tell why I still have faith in OCK despite the stock price had shot up another all-time high RM1.52 on 15.5.2014. Notwithstanding the recent announcement of the proposed bonus issue and transfer to Main Board, there will be another rather interesting development soon that, I believe, will rally the stock price once again. Since late last year, the stock had gathered some interest partly because of the news of this impending transfer to Main Board. This has come true with recent announcement albeit a bit late. The late was delibrate. At the same time, the bonus issue has give another round of boost. These news will certainly make OCK continues to be in favourable mood for some time. Ain't this suppose to be the purpose - continue to create news and maintain the mood for as long as possible. And don't forget about the news of private placement as well. The corporate side of story is getting more and more exciting.

And also, this come at the backdrop of the lucrative towers business which has been made known to all and sundry by the government that they will be spending RM1.5 billion within the next 3 years. The tower job supposes to start this year if everything goes as planned. By saying everything goes as planned is not the usual meeting the technical requirement as planned but more on the works to connect the dots. Someone has to complete the job on time anyway, either by party A or party B. The one with the expertise will get the job, be it at first level or at second level. Either way, it is still a lucrative contract.

By the way, Presbhd's stock price has almost recovered and quite uniquely if you get what I mean. Invest for long term is much more comforting and relax, don't you agree.

Its price (OCK) closed at RM1.45 on 16.5.2014.

Thursday 15 May 2014

Google Inc - the giant company

It feels nice to receive letter from one of the most expensive company in world and all the way from the State.

Google is well know not only for its search engine but also lots of others unique and innovative ventures. Google Earth is one of my favourite apps. Another is this Blogspot which is powered by Google. The latest is the glass tech car. It was in the news yesterday. It is a driverless car where the driver literally is relegated to become a mere passenger. The car drives itself.

Google stock price used to trade at around USD1,000 per unit. Yes. Slightly above a thousand USD for a unit. Share split 1 for 2 on 03.4.2014 and now the stock is traded at a more affordable price around USD 526 per unit. There are 674 million outstanding shares. Market capitalisation is USD 355 billion or RM 1,065 billion. And, this is just one company. To put thing into perspective, our entire KLSE market capitalisation is RM 1,745 billion as of today.

If you have been to Google office, you will be awed by it. Look at some of the photos below.

|

| Google contracts with stylists to give its employees cut-rate haircuts |

|

| Google subsidizes professional massage for their staffs |

|

| Staffs are permitted to bring their dogs but not cats to their workplace |

If you are a boss yourself, it is better not to let your staffs know that there is such a heaven for workplace.

The Googleplex is the corporate headquarters complex of Google, Inc., located at 1600 Amphitheatre Parkway in Mountain View, Santa Clara County, California, United States.

"Googleplex" is a portmanteau of Google and complex and a reference to googolplex which means 10(10100) , or 10googol where googol =

= 10,000,000,000,000,000,000,000,000,000,000,000,000,000,000,000,000,000, 000,000,000,000,000,000,000,000,000,000,000,000,000,000,000,000.

.... a very big number, signify itself a giant company. It is definitely one, no question about it.

Its price closed at USD526.65 on 14.5.2014.

Tuesday 13 May 2014

Small Caps Stocks - there are still many gems

This post was in my draft folder for some time as I was too busy to complete it. I think it is good to keep the newspaper clips for future reference. By the way, OCK price has more or less recover from its lowest. Its price went all-time high at RM1.44 on 10.4.2014 before went down for a month with lowest price at RM1.20 on 29.4.2014. However, yesterday has somewhat recovered when its price closed at RM1.39. If you have parked your money in OCK after my last post on OCK and do nothing and go away for a month or two, you may have save yourself some heartbreaks to watch the price retraced by almost 14% from the highest. Yes. That is how volatile stock price can be once it is in the radar of the big boys. Anyway, let me add this. I am ever more convince that the OCK is going to do well this year after my latest chat and info that I am privileged to have and know.

On another note, will Presbhd recover from its doldrums price after the bonus issue? Will it recover just like OCK? You won't need to ask these questions if you invest for long term. Stock market is big boys' game and speculator/short-term/contra players are mere spectators.

Scanning through the local newspaper business reports compiled by my team and some had caught my attention.

Apparently some research outfits have started to cover OCK which was relatively unknown stock last year. My first comment on OCK in this blog was in December last year. Looking back, the stock price has since increased by 50% with the closing price of RM1.27 on 30.04.2014. Having said that, there are still more rooms to go this year. I say this not only because I believe in it but because I know why I am saying it.

I am building up my stocks purchases into our newly minted portfolio PZJA14M04. The first one stock being Hovid. I believe Hovid will be in the strong story interest in time to come just like what happened to Presbhd and OCK which took them over a year or two to be in the limelight. I would willing to invest and wait a year or two to realise 100% gain rather than shorting here and there for short term gain. I prefer to have long term target rather than short term target because short term target will always trigger the question of "what next stock to buy" very often. Only experts could know "what next stock to buy" every other day. But how many are there really real stock experts in the stock market?

Thursday 1 May 2014

US DJIA closed at all-time high 16,580

The Dow Jones industrial average (DJIA) closed at an all-time high 16,580 on Wednesday 30.04.2014. This rose above its previous record closing high of 16,576.66 recorded on 31.12.2013.

Three of its widely tracked indexes rose overnight in US. They are :-

1) DJIA rose 45.47 points, or 0.3 percent, to 16,580.84.

2) S&P500 gained 5.62 points, or 0.3 percent, to 1,883.95.

3) NASDAQ composite climbed 11.01 points, or 0.3 percent, to 4,114.56.

I was excited with the US stock market performance despite my very limited exposure to their stock market. Nevertheless this certainly lifted the mood and sentiment here. It is always feel better when US market is up rather than down. As usual, all the doomsayers continue to pour cold water. In fact, they have been at that since last year when DJIA hit 16,000, NASDAQ hit 4,000 and S&P hit 1,800 points. Sadly, their doom stories will come true one day for sure but it is not now. Enjoy the good time while it lasts but always be vigilant.

|

| Stocks Component of DJIA |

DJIA hitting its first record close of the year came at the time when Federal Reserve further reduces its monthly bond purchases. It trimmed its monthly asset purchases to $45 billion, making its fourth consecutive $10 billion cut. However, Wall Street seems to welcome the news. Their central bank said the economy has gained traction recently after a sharp slowdown. I think the Fed gives what the investors are expecting and this provides stability, hence Wall Street welcomes the news.

|

| NYSE at Wall Street |

Most important, the Fed intends to keep interest rates near zero until 2015 and this may come true.

Coming back home here, the KLCI index is holding quite steadily as well despite some sell-down in small cap stocks few days ago. KLCI recorded an all-time high close of 1,871 yesterday 30.04.2014. But the excitement is somewhat muted.

Subscribe to:

Posts (Atom)